This post was written for Finding True North by Gustavo Oliveira, Aeroplan afficionado and frequent flyer from the North.

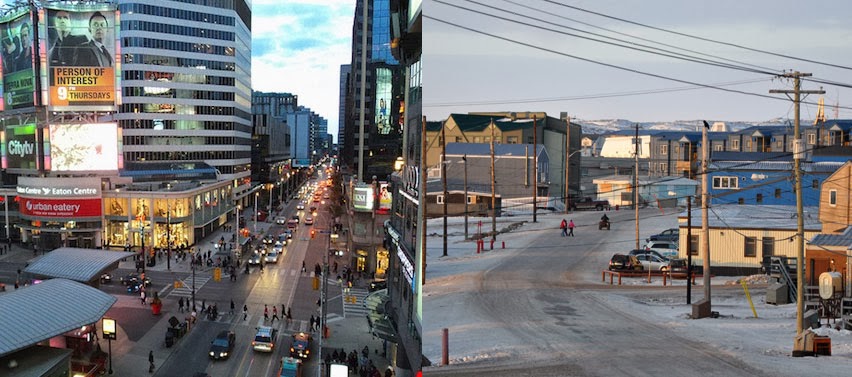

Readers of this blog are well aware of the incredibly high costs of traveling in the North, particularly in Nunavut. That is, unless you fly Aeroplan to Iqaluit. Knowing of my general aviation geekiness and thrifty ways, Anubha asked me to write a post about earning and using Aeroplan for people living in or travelling to Nunavut. So, I wrote this post to share my money-saving, miles-earning secrets for Finding True North readers so that you, too, can save up to $2200 per trip.

This guide to Aeroplan in the North is divided into two parts. In this post (part one), the focus is on choosing the right Aeroplan credit card, and how to maximize earning points. In part two, the emphasis will be on how to book reward flights on Northern carriers.

How to get miles fast

It takes 15,000 Aeroplan points to fly return from Iqaluit to Ottawa or Montreal. If you’re an Iqaluit resident who likes to travel down south, this means that you will need a lot of Aeroplan miles. The easiest way to earn thousands of Aeroplan miles quickly (provided you have a decent salary and credit rating) is to sign up for Aeroplan credit cards. Credit cards often come with generous Welcome Bonuses of tens of thousands of miles. The other component of earning miles through credit cards is through day-to-day transactions. If you’re going to buy stuff anyway, you might as well earn rewards at the same time.

The card you choose depends on a number of factors, including your spending habits, how much you want to invest in a credit card (many of these cards have hefty annual fees), and your travel desires. There are lot of rewards cards that link to various loyalty programs; that being said, for most Nunavummiut, Aeroplan miles are the most useful and lucrative reward for money well spent.

So which card should you choose? There are several Aeroplan cards available; I have reviewed the most popular options, based on personal use and features of each card. There are two main purveyors of Aeroplan cards: American Express and Visa. Notable cards under each company are listed below.

Aeroplan Cards with American Express

If you’re thinking of applying for these cards, please use the referral links in the post. Not only will you be eligible for a bunch of Aeroplan points, but you’ll be supporting the blog!

The Amex AeroplanPlus Platinum is by far the best card to start with if you have little to no miles in your Aeroplan account. With a referral from someone who has this card, you can earn up to 51,000 miles (your referrer will receive 15,000 miles). Although the annual fee is pricey, it is worth paying when you take into account the huge mileage bonus and the fact that this card has the highest earning ration for all other types of purchases. In addition, you get a free complimentary ticket for a short-haul flight; if you’re flying out of Iqaluit, that means this 2-for-1 deal will save you around $2000, which pays for the annual fee several times over.

The Amex Gold Rewards card is a good card if you already have some miles on your account. The maximum bonus, achieved only with a referral from someone with this card, is 25,000 Membership Reward points, and there is no annual fee for the first year. This means that you can cancel the card after receiving the bonus miles, although I recommend keeping it for the rest of the year since this has a better earnings ratio for certain purchases. One key difference with this card is that it does not get you Aeroplan miles directly. The points earned here are called “Membership Rewards” (MRs), which are part of Amex’s rewards program. These points are can be instantly transferred to Aeroplan at a ratio of 1:1, so no loss there.

The Amex AeroplanPlus Gold card is a good option if you want more bonus miles only. I find that the earning ratios and other benefits such as 2-for-1 companion ticket and Maple Leaf Lounge access make the AeroplanPlus Platinum card superior to this one. However, this has a great bonus offer, and there is no annual fee for the first year – that means you can get 30,000 miles for free; just cancel the card after one year. Again, keep in mind the spending limits to make sure you get all bonuses. Use this referral link to sign up.

Aeroplan Cards with Visa

With the “switch” of Aeroplan Visa issuing banks to TD this year, there has been a slight change with Visas. “Slight change” because there are two new TD cards, but they’re not that great (surprise). Thus, I will focus on the one I think is most relevant (TD Aeroplan Infinite).

Both the CIBC Aerogold Visa and the CIBC Aerogold Visa Infinate cards have the same earning ratios and annual fees. The only difference between the two is in the insurance that comes with them (Aerogold Infinite is better than Aerogold, but minimum requirements to qualify, e.g. household income, are higher).

The different TD Aeroplan cards aren’t that different in terms of bonuses and earning potential. In my opinion, the Aeroplan Visa Infinite Privilege card is a rip off and requires an annual household income of $200k (WTF), and the Air Canada benefits that come with it aren’t worth it. The only TD card that compares with the CIBC Visas is the Aeroplan Visa Infinite, whose benefits are the same as the CIBC cards.

It’s always good to have an alternative card for when Amex isn’t accepted. I recommend getting the CIBC card right now (Aerogold or Aerogold Infinite, doesn’t really matter) due to the bonus miles and automatic free year. You may then apply for a TD card and cancel your CIBC after receiving the 5000 mile bonus.

Maximizing Your Aeroplan Earnings

Now that you know which cards to have to get bonus miles, use the earning ratios to your advantage. Need to book a hotel? Use the Amex Gold Rewards for double Aeroplan points. Have a cold and need drugs? Use one of the Visa cards to get 1.5 miles per dollar. Have a purchase that doesn’t fit within drugstores, travel, grocery, or gas categories, such as an Amazon purchase? Use the Amex AeroplanPlus Platinum for 1.25 miles per dollar.

This seems complicated, but you’ll get the hang of it. Just remember which cards give you bonus points and for what types of purchases.

If you stay in hotels a lot, another easy way of earning more miles is to choose hotels that have bonus promotions for the time period of your stay. You do this by going to Aeroplan’s partners section and look for the rewards programs of the hotels available where you want to go to (select Travel>Hotels). The same applies for car rentals and other travel needs.

Another very easy way of earning miles is through buying things online using the Aeroplan eStore. You could call this double dipping – you will earn miles for using your credit card plus miles buying things through the eStore. By selecting one of the participating retailers, your order is tracked by the eStore so that you receive miles (a minimum of 1 mile per dollar, taxes excluded) in addition to what you earn for using your Aeroplan credit card.

The eStore often has promotions of 5x or 10x the miles, so you can capitalize on this quite easily. For example, I recently bought an Apple laptop using the eStore. To simplify the calculation, let’s assume it cost me $2000. The eStore had a 5x the miles promo at the time, so simply by using the eStore I earned 10,000 miles (2000 x 5) by purchasing the computer on Apple’s site via the eStore affiliate link. In addition to this, I used my Amex Aeroplan Platinum card, so I earned an additional 2500 miles (2000 x 1.25) just for using the card. In the end, this one purchase alone almost got me a short-haul flight (total of 12,500 miles).

These are some basic tips for earning more Aeroplan miles. Please let me know if I missed anything crucial, and stay tuned for part two: how to book reward tickets on Northern carriers.

Gustavo Oliveira knows a thing or two about air travel in the North. Not only can he correctly identify planes in the sky, but he used to fly out of Iqaluit almost once a month on points. Having recently left Nunavut for the Northwest Territories, Gustavo is changing his credit card strategy to find the best deals out of Yellowknife! To get in touch, you can creep him on Instagram or send him an email.

![[GUEST POST] Aeroplan to Iqaluit, Part One: Choosing the Right Credit Card](http://findingtruenorth.ca/wp-content/uploads/2014/03/gustavo-ticket-2-970x490.jpg)

![[GUEST POST] How to Buy Alcohol in Iqaluit](http://findingtruenorth.ca/wp-content/uploads/2014/10/IMG_7936-970x490.jpg)

![[Guest Post] Iqaluit Community Greenhouse: Oasis in the Tundra](http://findingtruenorth.ca/wp-content/uploads/2014/07/375665_10151742048070379_1152923082_n-612x490.jpg)

![[GUEST POST] Absolute Car-nage: A Field Guide to the Bumpers of Iqaluit](http://findingtruenorth.ca/wp-content/uploads/2014/07/iqaluit-field-guide-970x490.jpg)

![[GUEST POST] How to Sealift to Iqaluit](http://findingtruenorth.ca/wp-content/uploads/2014/06/sealift-bay-970x490.jpg)

![[GUEST POST] Communications: Nunavut News Thursday, May 22, 2014 13:30](http://findingtruenorth.ca/wp-content/uploads/2014/05/DumpFire-970x490.jpg)

![[GUEST POST] Iqaluit to Kimmirut and Back, in 17 Verses](http://findingtruenorth.ca/wp-content/uploads/2014/05/lede-1-859x490.jpg)

![[GUEST POST] Floppy Sock](http://findingtruenorth.ca/wp-content/uploads/2014/04/6-970x490.jpg)

![[GUEST POST] Gustavo’s Guide to Aeroplan, Part Two: Booking a Reward Ticket](http://findingtruenorth.ca/wp-content/uploads/2014/03/plane-960x490.jpg)

![[Guest Post] 10 Ways Iqaluit is Like a Campus](http://findingtruenorth.ca/wp-content/uploads/2013/12/picstitch-970x490.jpg)

Pingback: Gustavo's Guide to Aeroplan, Part Two: Booking a Reward Ticket - Finding True North

Pingback: Getting to Iqaluit - Finding True North

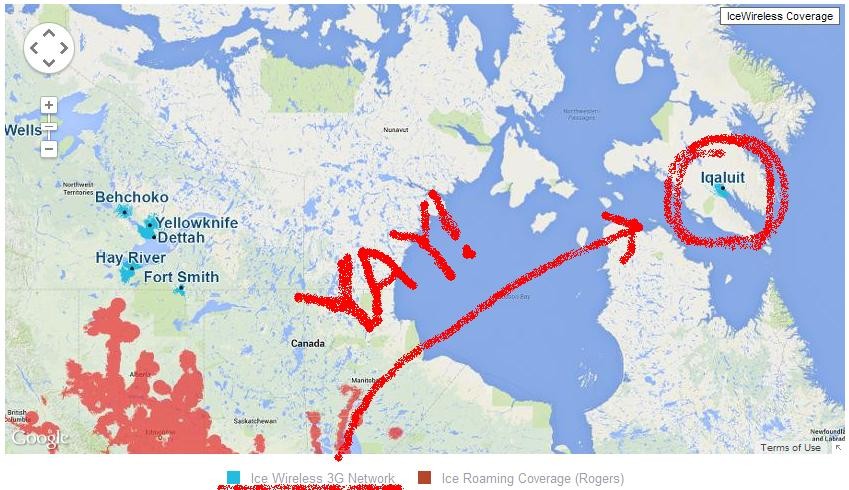

When I try to book a flight from Ottawa or Montreal to Iqaluit using aeroplan website, I does not find Iqaluit as an available destination. How do you book a flight to Iqaluit using Aeroplan?

Hi there! You have to book Aeroplan tickets to Iqaluit over the phone! Check out this post for more information.