This is a guest post by Martin Manning, a Chartered Accountant and founder of The MBA Experiment. For more guest posts, click here!

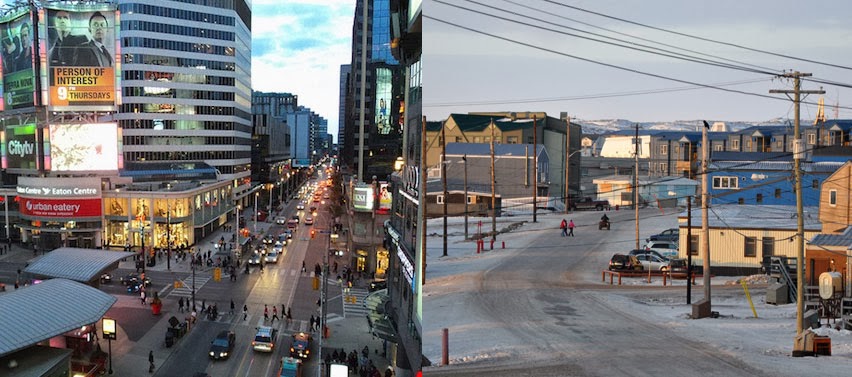

Winter is almost over, which means it’s time to start thinking about the next awesome season. That’s right: tax season is upon us. If you spent last year racing around at the deadline, don’t panic! Instead, read this guide to help you figure out how to do your taxes in Nunavut. We answer some of the most common tax-related questions so that this year, you can spend the season relaxing.

Tax Terms

- Canada Revenue Agency (CRA): who you file your taxes with

- Tax year: January 1 – December 31, 2015

- Filing deadline: April 30, 2016

- RRSP deadline: February 29, 2016

Do I have to file a tax return?

Simply put, unless you’re self-employed, if you owe taxes you have to file a tax return and pay your taxes by April 30th every year. The self-employed have until June 15th to file a return but if taxes are owed they must still be paid by April 30th. It’s better not to leave it to the last minute because if something comes up and you don’t file on time, you could be facing steep penalties and interest charges.

You may be asking how to find out if you owe taxes. Well, it depends how you get your money. If you have a job, normally your employer has been withholding a portion of your pay and submitting it to the CRA towards your taxes. Often this is more than enough to cover your tax bill.

If you’re self-employed and have been having a good year, you’ve either been making regular tax instalments throughout the year – or are about to find out you owe a lot of money.

Regardless of how you make a living, if you are earning income, you basically have to do your taxes to find out if you owe taxes.

I know that I don’t owe taxes; should I still file a return?

Generally, yes. Even if you don’t owe taxes, you could be leaving money on the table by not filing a return. A number of government benefits such as the GST/HST Credit and the Canada child tax benefit are linked to filing a tax return.

The most common reason to file a return when you don’t owe taxes is to claim a tax refund. Remember when we said oftentimes your employer withholds more than enough to cover your tax bill? Well if that is indeed that case for you, you will need to file a return to claim the refund. No tax return = no refund.

What do I need to file my taxes?

Now that you’ve decided filing a tax return is right for you, let’s take a look at what you’ll need to do so:

Information Slips – These are those weird pieces of paper with a bunch of numbers in boxes that start showing up in your mailbox such as the T4 Statement of Remuneration Paid (for every job you had during the year) and the T5 Statement of Investment Income (received for interest and dividend income). You should receive most of these in February though some can come as late as the end of March.

Investment Activity – Did you sell any investments during the year? If so, you’ll need the investment activity from anywhere you invest to calculate your capital gains or losses.

Other income/expense information – Do you run your own business? Have a rental property? Be sure to gather all related income and expense invoices.

Receipts – Track down receipts to support donations, medical expenses, travel costs, and anything else you plan to lower your tax bill with.

How can I lower my tax bill?

When it comes to lowering your tax bill it pays not to procrastinate. Most avenues require action during the tax year but maybe you’ve been doing things you can deduct from your taxes without even knowing it.

Let’s have a look at some of the most common ways to lower your taxes:

- Registered Retirement Savings Plan (RRSP) – A special account you open with a bank or investment broker which, as the name suggests, is aimed at helping you save for retirement. To encourage you to do so the CRA lets you lower your taxable income by the amount you contribute to it. Keep in mind that any money withdrawn from an RRSP is fully taxable.

- Tax-Free Savings Account (TFSA) – Another special account you open with a bank or investment broker. Any income earned on investments purchased within a TFSA is, you guessed it, tax-free.

- Business expenses – If you’re self-employed, review CRA’s long list of business expenses you may be able to deduct from your income.

- Moving expenses – If you moved more than 40 km for a new job or to attend school full-time you can claim many moving expenses that you paid and were not reimbursed for.

- Tuition – If you were a post-secondary student during the year you will need a T2202A Tuition, Education, and Textbook Amounts Certificate to calculate your tax credits. Depending on your school you may need to download this from your school’s website.

Want to lower your taxes even more? Check to see if any of these apply to you:

- Medical expenses

- Donations

- Union or professional dues

- Interest paid on student loans

- Child care expenses

- Children’s fitness tax credit

- Children’s arts tax credit

Is there anything special about doing your taxes in Nunavut?

If you’ve talked to anyone about taxes in the North, you’ve likely heard about the Northern Residents Deduction – and with good reason, as it can significantly lower your tax bill. To be eligible to claim this deduction, you must have lived in a “prescribed northern zone” (Nunavut, for example) for a continuous period of at least six consecutive months.

If you qualify for the whole year, the basic residency amount will knock over $3,000 off of your taxable income. And if you’re the only one in your household claiming the Northern Residents Deduction, you’ll be eligible for an additional residency amount, doubling the deduction.

In addition to the basic and additional residency amounts, there is also a deduction for travel benefits, which could reduce your taxable income even further. Check your T4 slip from your employer to see if you have an amount in Box 32. If you do, you can claim the expenses of two trips alongside the residency deduction on Form T2222.

Are there any other Northern tax breaks?

Being in Nunavut there are a couple other tax breaks available to you on Form NU479. The most interesting of which is the cost of living tax credit, worth as much as $1,200 or even more if you are a single parent.

How do I file?

So you’ve got everything together and are ready to file your tax return. Let’s take a look at your options:

Paper – This is technically still an option. If you really love putting pencil to paper you can pick up a tax package at any Canada Post or Service Canada Office. You can also download and print all the forms from the CRA website… at which point you should probably just consider filing online.

Online – Doing your taxes online has become easier and easier in recent years. To get started you’ll need to make sure you’re signed up with CRA My Account and then choose a certified tax software option, many of which are free to use. The process is usually as simple as answering a few questions based on the info you’ve already assembled and then clicking to submit to the CRA. That’s it.

Hire a pro – If you have a complex tax situation or just feel overwhelmed, it may be worth getting in touch with an accounting firm to see how they can help you out. The tax savings can often offset the cost, plus you get the peace of mind in knowing it’s done right. In Nunavut, you have Lester Landau and Northern Financial Services as options. If you find yourself somewhere else during tax season, a quick Google search should find you many accounting firm options (full disclosure: I do contract work for Lester Landau).

Okay, I’ve filed. Now what?

If you have balance owing, you’ll need to make a payment either online or at your bank.

If you’re waiting on a refund or just want to follow the status of your return, you can do so through your CRA My Account. To speed up the processing of a refund, make sure your direct deposit info is up date.

See how easy that was? Whether you’re doing your taxes in Nunavut or anywhere else, all you need is a little prep to ensure you’ll have peace of mind in April, with your taxes done right and on time.

Martin Manning is a Chartered Accountant who has been travelling to Nunavut on contract since 2012. He grew up on Prince Edward Island and has worked, lived, or travelled extensively throughout Canada, Brazil, Colombia, Mexico, China, Albania, and France. He is a co-founder of the social clothing company kioha and can currently be found somewhere between Paris and the Canary Islands researching and writing for The MBA Experiment. Check him out on Twitter, Facebook, and Instagram.

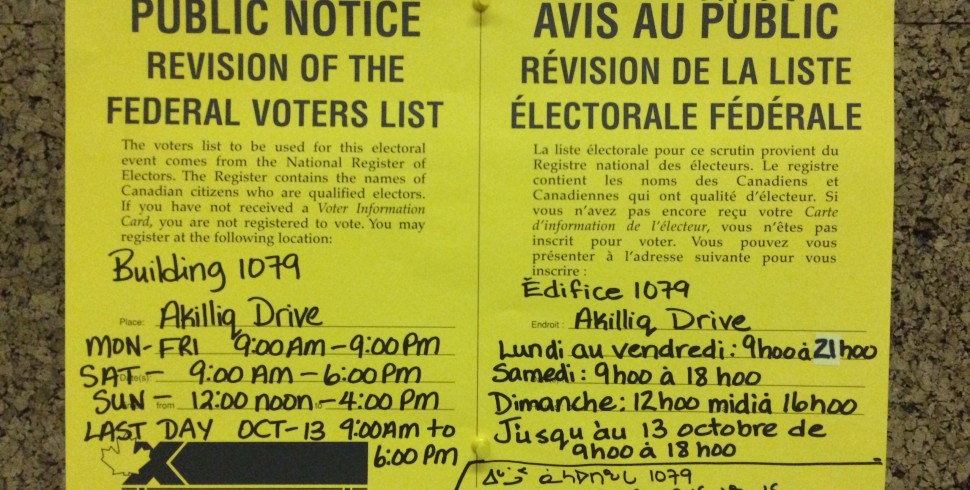

Hi, I’ve seen different takes on the Northern Residents Deduction (Line 255) and the term “a continuous period of at least six consecutive months.” Specifically, on whether the entire six consecutive months must have been completed in the *previous* tax year or whether they can be ongoing. E.g. you move to Nunavut in August and have not left and then go to file your taxes in March / April — do you qualify for the deduction or not…?

The CRA site also says “This period can begin or end in the tax year specified on Form T2222, Northern Residents Deductions.” –> Which to me implies that yes, you can claim it even if the entire six months did not occur in the tax year.

Anyhow, if anyone has any thoughts on this, feel free to comment as this will be my first year doing our taxes up here. Thanks!

You’ve got it! As long as you have lived in Nunavut for six consecutive months by the time you file your return you can claim the deduction for the months that fall in the tax year. In your case, the five months from August to December.

A slightly more complicated instance where the deduction could get overlooked is when one moves to Nunavut in November or later. They will not have met the six month criteria by April and thus cannot claim the deduction at the time of filing. However once May/June rolls around they can file a T1 Adjustment Request and their return will be adjusted to include the deduction.

That’s awesome! You are now the only place on the internet clarifying that. Thanks for the reply and great post! I will definitely be coming back to it.

Woohoo! We won! Thanks Anactoria.

What happens with the following year’s taxes if you move to a new province midway through the year? For example, you move to Nunavut in August 2015 and move away from Nunavut in June 2016. For your 2016 income taxes can you claim Nunavut Resident status for the period from Jan to July?

Yes, as long as you’ve met the criteria of living in Nunavut for a continuous period of six consecutive months you can claim whatever portion of it that falls in the new tax year before you move away.